Let's turn your goals into plans.

Make homeownership a reality.

We can guide you through the process of finding the home loan option that’s best for you.

- New homes, refinancing, investment and vacation properties

- Competitive rates and personalized service

Subject to credit approval.

Coin CheckingTM for the digital world.

The account that's ready to use and ready to help you take control of your money.

- $0 minimum balance to open*

- $0 monthly service charge

Learn more about Coin Checking

*Terms and conditions apply.

Building credit starts with a strong foundation.

The Simmons Bank Foundation VISA® Credit Card is designed to help establish and strengthen your credit and has a credit limit between $300 minimum and $5,000 maximum secured by your interest-bearing Foundation Secured Savings Account.

Your future starts today.

Whether you're saving for college or working toward retirement, our goal is to make a difference—for you, your family and your future.

- Solutions to build, preserve and manage wealth

- Practical and personalized guidance

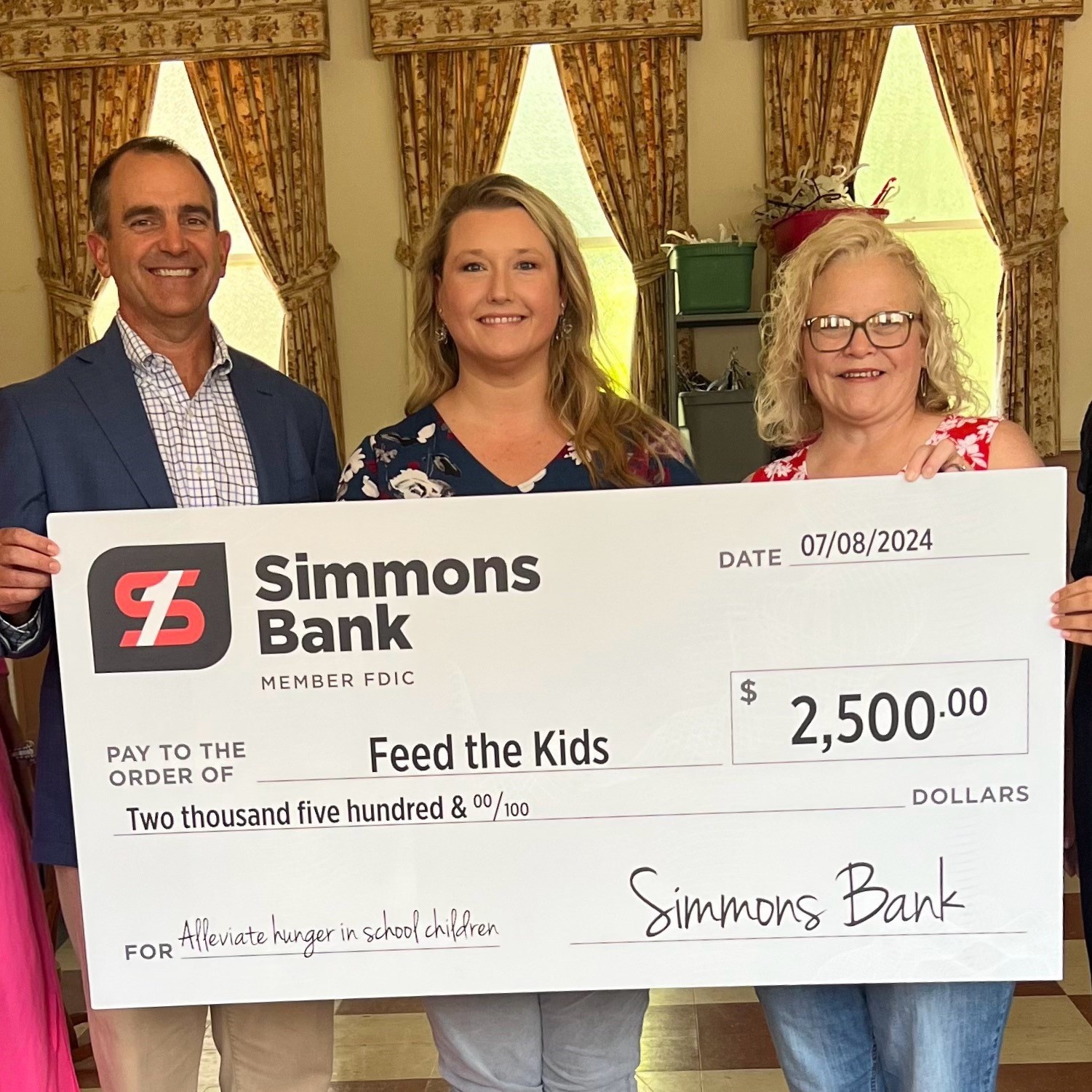

We live here, too.

As a business, Simmons Bank lives up to our responsibilities. As a neighbor, we will always contribute to our communities.

-

{165} All accounts subject to approval. Restrictions apply.