Non-Profit Checking

A checking account designed with non-profit business in mind.

- $50 Minimum Balance to Open

- Tailored to non-profits

Designed with your business in mind.

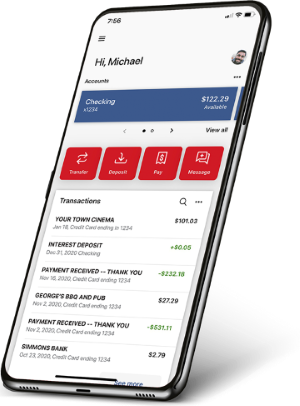

Simmons Bank Online and Mobile Banking lets you view and manage your money from any location.{16}

Go paperless and avoid a $5 paper statement fee.

Simmons Bank Online & Mobile

- Check your statements

- Transfer funds

- Deposit checks

- Manage and pay bills

- Setup card alerts

- Access business services

Get all of these features and more when you sign up!

-

{256} Additional terms and conditions apply. Please see the Terms and Conditions of Your Account for additional information.

-

{165} All accounts subject to approval. Restrictions apply.

-

{253} Business Loan means any loan or line of credit extended by us for business purposes excluding business and corporate credit cards, mortgage warehouse loans, and equipment finance agreements; consumer loans and any other loan issued for personal, family or household purposes do not qualify. An Open Business Loan is a Business Loan for which the primary owner using the same EIN/TIN as this account is the primary borrower and that currently has an outstanding balance or an available line of credit from which a borrower may obtain draws or advances (unless the Business Loan is charged off). Current Balance is determined by the outstanding balance of the Business Loan as of the last day of the statement cycle. Current Balance excludes, as applicable, interest which has not yet been posted and pending payments which have not posted.

-

{16} Data connection required. Wireless carrier fees may apply. Mobile deposit is available to Simmons Bank online and mobile banking customers who are at least 18 years of age and have the most recent Simmons Bank App for iPhone®, iPad®, or Android™.